utah food tax increase 2020

Follow this link to view a listing of tax rates effective each quarter. Washington DC April 22 2020 Today the US.

States Tackle High Gas Prices With Tax Holidays Rebates For Residents

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

. If you have any further questions we are always happy to discuss. The IRS will start accepting eFiled tax returns in January 2020. The Utah Department of Revenue is responsible for publishing the latest Utah State Tax.

The Utah State Tax Commission periodically issues Tax Bulletins outlining tax-related issues. It does not contain all tax laws or rules. Many lawmakers have been itching to do this for years virtually ever since former Gov.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

For tax rates in other cities see Utah sales taxes by city and county. Lowered from 8 to 675. Two states Louisiana and Mississippi began requiring marketplace facilitators to collect sales and use taxes.

Tax years prior to 2008. The following sales tax changes were made effective in the respective quarters listed below. Heidi Rosenberg of Tooele who works in marketing said she signed the referendum on her way into the store because shes concerned about the impact of the sales tax increase on food from the current 175 to the full state rate of 485 despite a new grocery credit of up to 125 per person for low- and moderate-income Utahns.

January 1 2018 December 31 2021. First Quarter 2008 Changes. Contact us for assistance.

Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. Bulletins are kept on this site for approximately three years. Simplify Utah sales tax compliance.

State Local Option. For security reasons TAP and other e-services are not available in most countries outside the United States. You can print a 775 sales tax table here.

As of January 1st 2020 the Chicago Restaurant Tax is 5 however in addition to the States 625 tax on food the Countys 125 tax and the Citys tax of 125 Chicago the total tax Chicago-based restaurants face is 925. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. There are -783 days left until Tax Day on April 16th 2020.

The tax reform package would increase the states portion of the sales tax on food from 175 to 485. Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. The Utah State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Utah State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Why was this about the poor. Date Range Tax Rate. Special Needs Opportunity Scholarship Program.

Nineteen states had notable tax changes take effect on July 1 2020. January 1 2022 current. Beer Tax Rate Increase.

The standard deduction increased for inflation. Solar Energy Systems Phase-out. The latest sales tax rates for cities in Utah UT state.

Illinois now requires remote sellers to collect state and local. Using deductions is an excellent way to reduce your Utah income tax and maximize your refund so be sure to research. Recent Info and Tax Law Changes which details recent changes in tax laws including federal laws that affect Utah taxes.

See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. Secretary of Agriculture Sonny Perdue announced emergency benefit increases have reached 20 billion per month for Supplemental Nutrition Assistance Program SNAP households across all 50 states and 3 territories to increase food security during the coronavirus national emergency. Utah has a single tax rate for all income levels as follows.

Average Sales Tax With Local. The Utah income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. The maximum Renewable Residential Energy Systems Credit credit 21 for solar power systems installed in 2021 is 1200.

Report and pay this tax using form TC-62F Restaurant Tax Return. Always consult your local government tax. Pushed them to lower the tax more than a decade ago.

This graphic shows what this increase means to you. Castle Dale Huntington Hatch Panguitch and Taylorsville Impose Municipality Transient Room Tax. Taxpayers who dont itemize deductions can claim the standard deduction an amount predetermined by the IRS that reduces taxable income.

For security reasons TAP and other e-services are not available in most countries outside the United States. This page lists the various sales use tax rates effective throughout Utah. The restaurant tax applies to all food sales both prepared food and grocery food.

We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Rates include state county and city taxes.

It does not contain all tax laws or rules. 2020 rates included for use while preparing your income tax deduction. Chicago Restaurant Tax.

There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 2108. The Utah County Commission recently voted to adjust property tax rates. But it was a gross miscalculation of the publics wishes.

Gina Cornia director of Utahns Against Hunger and one of the referendums sponsors said restoring the full 485 state sales tax on food from the current 175 was what drove the opposition to the bill passed in a special session of the Utah Legislature last month despite the inclusion of an up to 125 per person grocery tax credit. The 2020 legislature passed. Find out more about the citys taxes on Chicagos government tax list.

January 1 2008 December 31 2017. We appreciate all who have reached out and are grateful for the time that we have had to visit with each of you concerning the 2020 tax rate. Raised from 81 to 82.

Indiana had the lone corporate income tax change with the rate decreasing from 55 to 525 percent.

Expected Da 2021 Aicpin For The Month Of February 2021 Consumer Price Index Expectations Last Day At Work

The U S Homeless Population Mapped Vivid Maps Homeless Emergency Shelter Homeless People

The Most Important Lesson I Learned As An Artist Arte Callejero Grafiti Fotos Linea De Arte

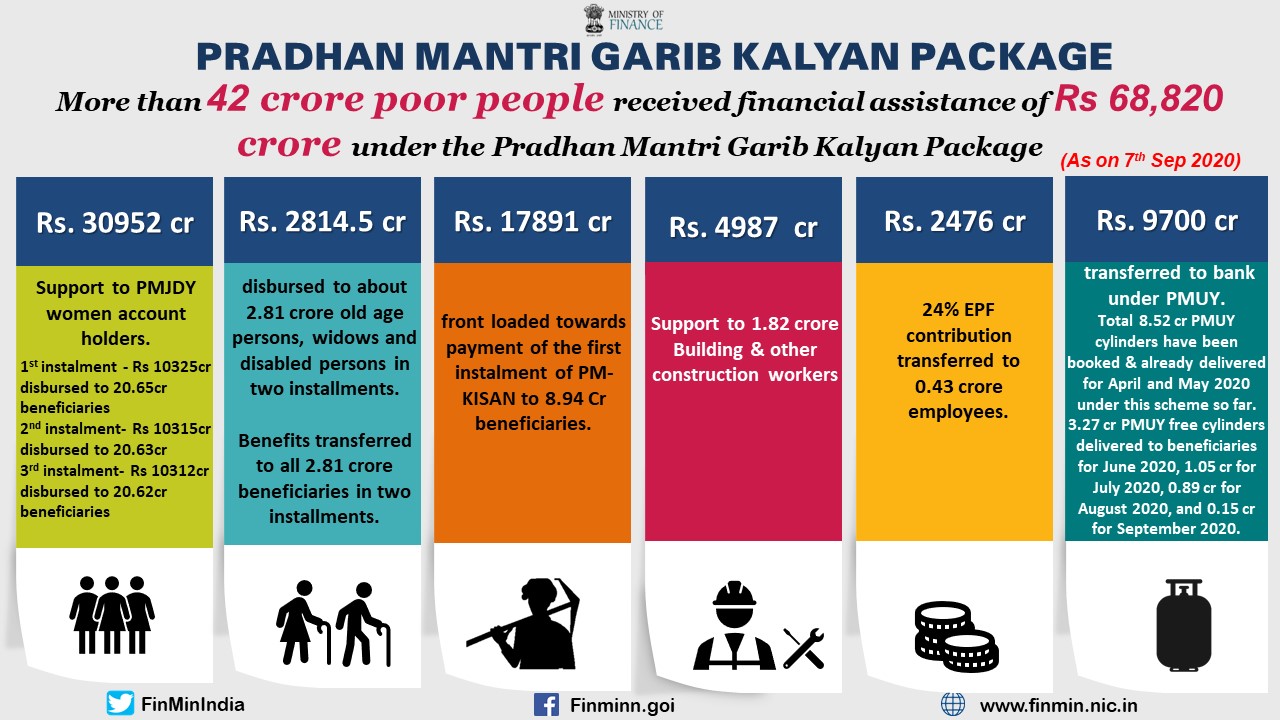

Pradhan Mantri Garib Kalyan Yojana

Everything You Need To Know About Restaurant Taxes

The Rules On Sales Taxes For Food Takeout And Delivery Cpa Practice Advisor

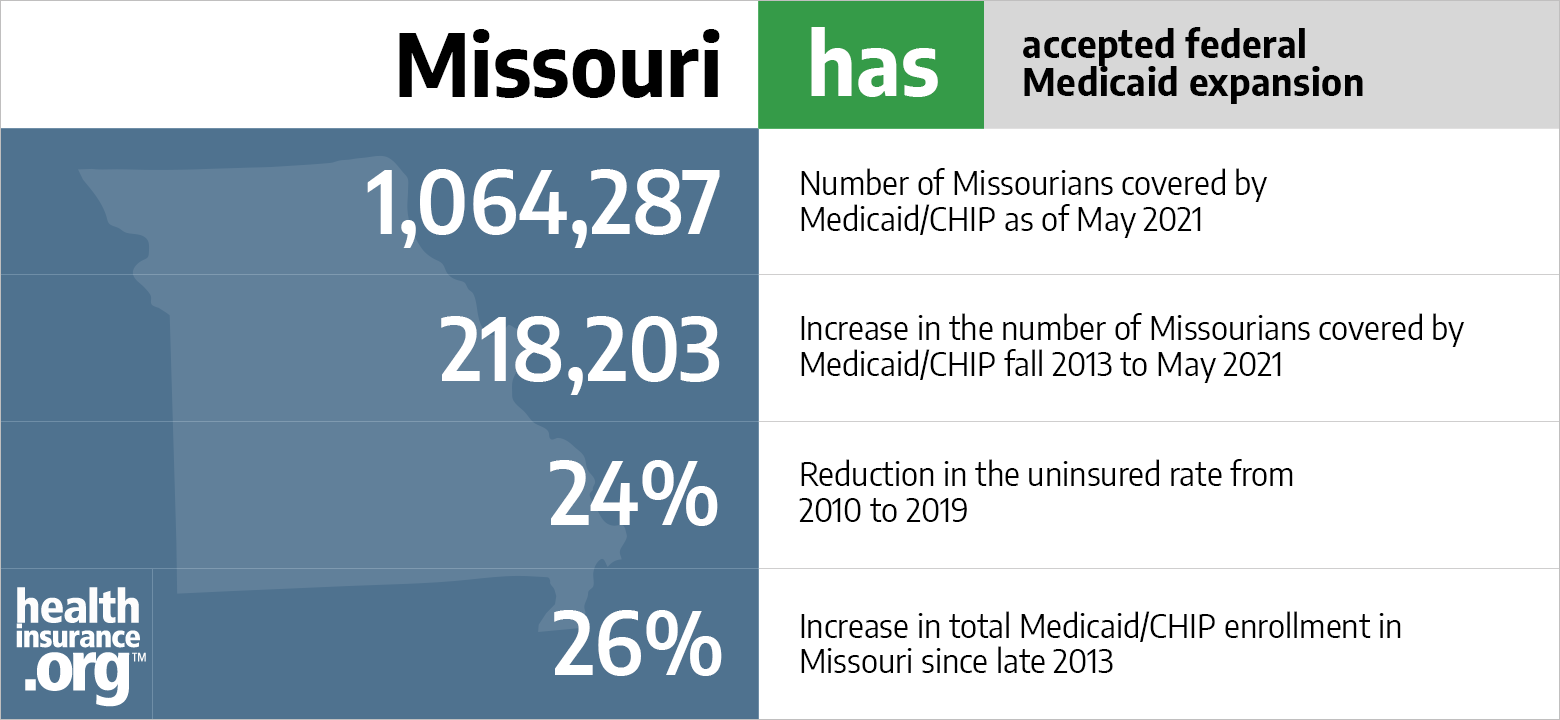

Aca Medicaid Expansion In Missouri Updated 2022 Guide Healthinsurance Org

Catat Wp Peserta Pps Perlu Perhatikan Ini Saat Hitung Harta Bersih

Avalara Tax Changes 2022 Read This Now Thank Us Later

Launch Of Vision 2020 We Gatherin Next Friday Barbados Today Barbados Product Launch People

Did Marriage Story Hit Close To Home Tell Us Your Story Beautiful Film Movie Shots Film Inspiration